Equity Bank’s James Mwangi Signs Landmark Deal With WFP in Italy to Empower Farmers

- Published By Jane Njeri For The Statesman Digital

- 1 year ago

Equity Group and the World Food Programme (WFP) have entered into an agreement designed to empower small-scale farmers across Africa.

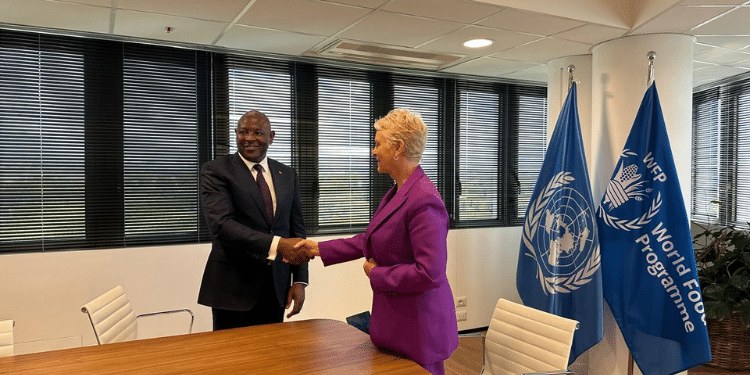

Dr. James Mwangi, Equity Group Holdings Managing Director and CEO and WFP Executive Director Cindy McCain signed the deal that aims to provide farmers with essential financial literacy training and accessible financing through Equity Bank subsidiaries.

The historic agreement, formalized on the sidelines of the WFP Executive Board Session in Rome, marks a new model of private sector engagement in sustainable development.

Through the Equity Group Foundation, the initiative will offer training and technical assistance to agri-processors and agri-preneurs, preparing them for impact investments.

Equity Bank Financial Services

This partnership leverages WFP’s extensive field presence and Equity Bank’s financial services to support marginalized communities where traditional financing is often inaccessible.

Through the Equity Group Foundation, the initiative will offer training and technical assistance to agri-processors and agri-preneurs, preparing them for impact investments.

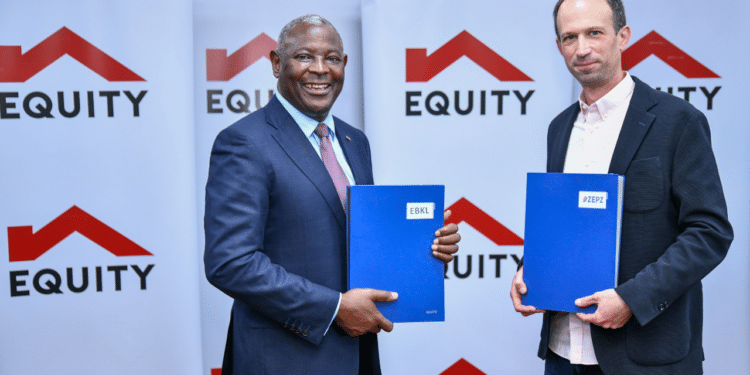

This collaboration expands on a previous project, “Promotion of Sustainable Food Security,” initiated in the Democratic Republic of Congo (DRC) in 2022.

The DRC project, supported by Equity BCDC, has already facilitated USD $10 million in loans to local value chain businesses, including smallholder farmers and cooperatives.

The new agreement aims to replicate and scale this success across the region.

James Mwangi on Deal With WFP

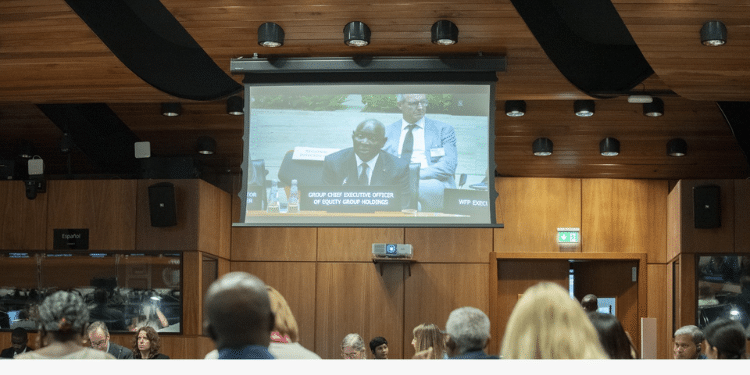

Dr. Mwangi, while addressing the WFP Executive Board, highlighted the critical role of the private sector in transitioning from food crises to resilient food systems.

He emphasized Equity’s commitment to supporting small-scale farmers, who represent 70% of the world’s 600 million farms.

“We want to work with partners like WFP to scale outputs and access to finance to facilitate investments in agricultural activities,” Mwangi stated.

He also noted the Group’s “Africa Recovery and Resilience Plan,” which aims to allocate 30% of Equity’s loan book to farmers by 2030.

Smallholder farmers play a vital role in food production, providing over 70% of food calories in Asia and sub-Saharan Africa.

Developing local food value chains is essential for enhancing farmers’ incomes and contributing to global food security.

Importance of this Partnership

Cindy McCain, WFP’s Executive Director, stressed the importance of private sector partnerships in achieving zero hunger.

“By empowering farmers with the tools and resources they need to thrive, we can create a ripple effect of prosperity that strengthens long-term food security for the whole community,” McCain said.

The partnership also focuses on farmer education, addressing climate resilience, regenerative agriculture, and financial management.

By providing affordable, accessible data and information, the initiative aims to help farmers understand and address their agricultural challenges effectively.

Equity Bank to Farmers

In May, Equity, along with founding partners such as Microsoft and Heifer International, launched the MADE Alliance (Mobilizing Access to the Digital Economy) to address the needs of over 100 million small-scale farmers.

Dr. Mwangi further affirmed Equity Group Foundation’s commitment to transforming the lives and livelihoods of millions of farmers.

“The food and agriculture pillar of the Equity Group Foundation has positively impacted the lives and livelihoods of 3.8 million farmers,” Mwangi said.

About Equity Group

Equity Group Holdings is a Pan-African financial services holding company listed at the Nairobi Securities Exchange, Uganda Securities Exchange, and Rwanda Stock Exchange.

The Group has banking subsidiaries in Kenya, DRC, Rwanda, Uganda, Tanzania, South Sudan, and a Commercial Representative Office in Ethiopia.

It has other subsidiaries in investment banking, insurance, telecom, fintech and social impact investments. Equity Group is the largest integrated financial services firm in the region with a market capitalization of USD 4 Billion.

The Group has an asset base of $13 Billion, customer base of 21 million supported by a footprint of 404 branches, 83,142 Agents, over 1.1 million Pay with Equity (PWE) merchants, 33,179 Point-of-Sale (POS) Merchants, 828 ATMs and an extensive adoption of digital banking channel.

Share on

SHARE YOUR COMMENT

MORE STORIES FOR YOU

Trending Stories

DJ Mo’s former illicit lo...

- Published By Jane

- January 15, 2024

Mapenzi! Zari and Tanasha...

- Published By Jane

- October 24, 2023

Zuchu Speaks on Diamond P...

- Published By Jane

- October 12, 2023

Hio Ni Upumbavu Wasituche...

- Published By Jane

- November 8, 2023

RECOMMENDED FOR YOU

Morocco Win CHAN 2024 Fin...

- Published By The

- September 8, 2025

Older, Richer and Wiser?:...

- Published By The

- September 8, 2025

The Psychology of Investi...

- Published By The

- September 8, 2025

Kenya’s Business Leaders...

- Published By The

- September 8, 2025

Latest Stories

Sad as At Least 19 Killed...

- Published By The

- September 9, 2025

US Court Upholds Ksh.10.7...

- Published By The

- September 9, 2025

Blow to Government as Hig...

- Published By The

- September 9, 2025

Live Update: French Gover...

- Published By The

- September 8, 2025